“It has a great feature set but there’s lots more we need to do.” “We’ll also continue to add to our Simplifi product, which is only about 18 months into its life,” he said. He said the company will simply focus on continuing the modernization of its Quicken product and bringing more functionality to its web and mobile offerings. In fact, Dunn expects the company will only continue to hire and add to its 150-person staff (not including 250 contracted “customer care agents).

No layoffs are planned with the new ownership. It’s not ruling out acquisitions, but it’s also not an area of emphasis. Moving forward, Dunn said Quicken plans to explore partnering with fintechs as it continues to evolve its model.

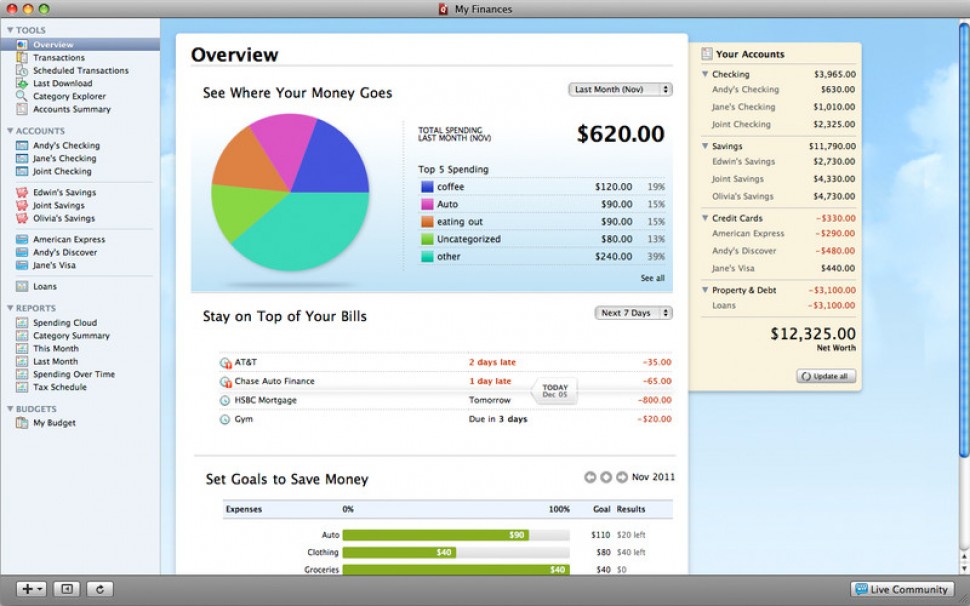

#QUICKEN SOFTWARE SOFTWARE#

“It started with the idea of automating personal finances to customers as a software tool living only on desktops.” “It was one of the founding fintechs, the only software product at Intuit when it launched in 1983,” he told TechCrunch. But, Dunn maintains, Quicken in fact was “the first fintech.” In recent years, the number of financial technology companies (and potential competitors to Quicken) has exploded. Capital, said the results of its investment in Quicken have been “outstanding.” Justin Reyna, managing director at H.I.G. They felt their work was done, and they did what they had set out to do,” Dunn said, “which is to carve out an asset with a lot of potential from a parent company which had neglected it.” (NPS stands for Net Promoter Score, a customer loyalty and satisfaction measurement). “More importantly, we’re a successful business that has succeeded in modernizing and improving quality for our customers.”įor example, according to Dunn, Quicken has seen an NPS gain of 25 points over a five-year period. We’re a very successful company, revenue-wise - far above what it ever was in the Intuit years,” he told TechCrunch. “We’re strongly profitable and have been consistently profitable since the time of the spinoff. The executive declined to reveal hard revenue figures but he did share that the company is profitable and has seen a 50% increase in annual sales volume over the five-year period, (or double-digit growth if you annualize it). It currently has 2 million active users, which Dunn said is “significantly higher” than what it had at the time of its spinoff from Intuit. buy, it appears that Quicken has grown quite a lot. While he was CFO, Dunn was also a software developer who worked on almost all of the early versions of Quicken, and was the first VP/general manager of the business.

During his tenure at Intuit, he served as the CFO through the 1993 IPO and merger with ChipSoft (now known as TurboTax). 4 in 1986 when Quicken was its only software product. While he took over as CEO of Quicken in 2016, he first joined previous parent company Intuit as employee No.

0 kommentar(er)

0 kommentar(er)